You’ve got homework.

Knowing your current financial situation helps you understand where you stand. This includes your income, expenses, debts, and assets. It’s like getting a clear picture of your starting point.

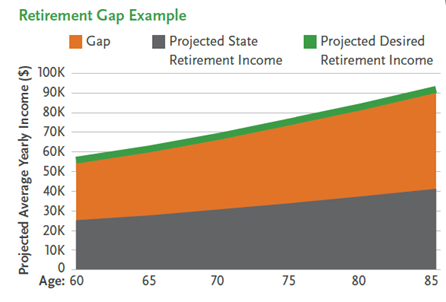

Retirement 101: Introducing the retirement income gap

Your retirement income gap is the difference between your income on your last day of work and your income in retirement.

our solutions are built for you

Your Assignments

#1 evaluate your current financial status

Take inventory of your current savings, investments, and income sources. Download and save statements as you go – so they’re easily accessible later on.

#2 get to know your state’s pension plan

Your state pension forms a crucial part of your retirement income. Confirm your eligibility and the amount you can expect from your state pension.

Go here and, in “Understanding Your State’s Retirement System”, select your state.

#3 calculate the future value of your pension

Go here and complete your retirement benefit calculation.

#4 read up on your district’s supplemental retirement plan offering

Your employer offers a retirement savings plan designed to work alongside your pension, helping to fill your retirement income gap. They may offer one or both plans below.

click on the “+” below to learn more about each plan

403(b) Plan

Understand your 403(b) options and how best to benefit from them.

403(b) is a retirement savings plan designed specifically for public school employees. Typically, 403(b) contributions are made pre-tax and grow tax-deferred while in the plan, allowing you to stretch your retirement dollars. You only pay taxes when you take it out of the plan.

The Roth 403(b), another common plan, works slightly differently. You pay taxes on the contributions up front, but your money grows tax-free and can be withdrawn tax-free.1

Saving in a 403(b) allows you to:

- Take control of your retirement security by contributing directly to a 403(b) savings plan through payroll deductions.

- Accumulate money on a tax-favored basis, to supplement your pension or another retirement plan.

- Keep your money, no matter where you go. Transfer your savings to other employer plans or into a traditional IRA if you leave your job.

1 To qualify for the federal tax-free and penalty-free withdrawal of earnings, a Roth account must be in place for at least five years, and the distribution must take place after age 59½ or due to death, disability, or a qualified special purpose distribution, which is a qualified first-time home purchase (up to a $10,000 lifetime maximum).

Optimize your 403(b).

403(b) gives you flexibility and control of your retirement savings. Most 403(b) plans allow you to change products within the plan that best match your risk profile. Have retirement savings from a former employer? Most plans allow you to move money from old employers’ retirement plans or IRAs into your 403(b), consolidating your savings into one place. Now might just be the perfect time to roll over your funds.

One of our financial professionals can help you move funds and recommend changes to your portfolio.

Roth 403(b) Plan

Another way to make the most of your retirement dollars is a Roth 403(b) plan.

While traditional 403(b) contributions are made on a pre-tax basis, Roth 403(b) contributions are made on an after-tax basis with qualifying tax-free distributions. Anyone eligible for a traditional 403(b) plan will also be eligible for a Roth 403(b) if your employer chooses to make such a plan available.

Roth 403(b) contribution limits are higher than Roth IRA contribution limits, allowing Roth 403(b) participants to accumulate more for retirement. Unlike a Roth IRA, there are no income limits for participation in a Roth 403(b).

Talk with one of our financial professionals for help deciding how best to leverage Roth 403(b) within your overall savings plan.

457(b) Plan

Understand how 457(b) fits into your retirement plan.

When reviewing your employer’s options, you may notice they offer a 457(b) plan. 457(b) is a supplemental retirement plan that is tax-deferred meaning you don’t pay taxes on your money until withdrawal. 457(b) plan offers flexibility to save on a tax-deferred basis, while still having access to your money through loans, and unforeseen emergency distributions if the need arises.

If your employer offers both a 403(b) plan and a 457(b) plan, contributing the maximum allowed to both plans can maximize your retirement savings. One of our financial professionals can help guide you through this process.

Congratulations!

With knowledge comes the power to course correct.

Questions?

Request A Consultation

Whether you are looking to better understand your options or get free advice from a local financial professional, we can help you find the answers you need to take the next step.

Call: (866) 243-7174

Additional Support

Helpful Calculations

National Life Group® is a trade name of National Life Insurance Company, Montpelier, VT, Life Insurance Company of the Southwest, Addison, TX and their affiliates. Each company of National Life Group is solely responsible for its own financial condition and contractual obligations. Life Insurance Company of the Southwest is not an authorized insurer in New York and does not conduct insurance business in New York. Fixed indexed annuities (FIAs) are issued by Life Insurance Company of the Southwest. Annuities have surrender charges that are assessed during the early years of the contract if the contract owner surrenders the annuity. Guaranteed lifetime income may be provided either by annuitizing an annuity, or through an annuity income rider. Riders are supplemental benefits that can be added to an annuity. Riders may be optional, may require additional premium and may not be available in all states or on all products. This is not a solicitation of any specific annuity. Guarantees are dependent on the claims paying ability of the issuing company. Fixed indexed annuities do not directly participate in any stock or equity investments. National Life Group and its agents are neither affiliated with nor endorsed by any state retirement plan, school system or government agency.

National Life Group is an Affinity Partner of the Association of School Business Officials International (ASBO) through its Corporate Alliance Partnership program.

TC7830297(0425)3 | Cat No 106511(0125)