We know the last thing teachers often have time for is retirement planning. That’s why we’ve created a few study guides to make it easier to learn about how to make a 403(b), 457(b), and annuities work for you.

Browse our reference library here.

A 403(b) is a retirement savings plan designed specifically for public school employees. They work alongside your pension, helping to fill your retirement income gap. Typically, 403(b) contributions are made pre-tax and grow tax-deferred while in the plan, allowing you to stretch your retirement dollars. You only pay taxes when you take it out of the plan.

The Roth 403(b), another common plan, works slightly differently. You pay taxes on the contributions up front, but your money grows tax-free and can be withdrawn tax-free.1

Saving in a 403(b) allows you to:

1 To qualify for the federal tax-free and penalty-free withdrawal of earnings, a Roth account must be in place for at least five years, and the distribution must take place after age 59½ or due to death, disability, or a qualified special purpose distribution, which is a qualified first-time home purchase (up to a $10,000 lifetime maximum).

A 403(b) gives you flexibility and control of your retirement savings. Most 403(b) plans allow you to change products within the plan that best match your risk profile. Have retirement savings from a former employer? Most plans allow you to move money from old employers’ retirement plans or IRAs into your 403(b), consolidating your savings into one place. Now might just be the perfect time to roll over your funds.

Your financial professional can help you move funds and recommend changes to your portfolio. Click here to connect with one of our financial professionals to get started.

Contributions are directly pulled from your paycheck, making it easy to contribute to your retirement nest egg on a regular basis. Just complete a salary reduction agreement to inform your employer and contributions will be automatically deducted from your paycheck. You can always change the amount of your contributions by completing a new salary reduction agreement. Your financial professional can tell you how your employer’s plan works. If you don’t have a financial professional, we can help.

Each year, the IRS sets annual deferral limits on how much may be contributed. That said, you may be eligible for special catch-up provisions if you are over 50 or if you’ve been with the same employer for a significant amount of time. Our local financial professionals can help you calculate your Maximum Allowed Contribution.

One of the key benefits of a 403(b) is that you have complete control of it, even if switching to a different school district. The portability feature allows you to roll over your accumulated funds to your new retirement plan. Or, if you prefer, you can leave your account in place and any balance has the potential to continue growing tax-deferred.

A lot of factors go in to answering this question—including employment status and age and access rules, which are set by your employer’s plan rules. We recommend connecting with your financial professional to understand your options and determine what’s right for you.

However, here are some things to know:

You have several options, which may include:

Talk with a financial professional to help you assess your options and decide what’s right for you.

When reviewing your employer’s options, you may notice they offer a 457(b) Plan. A 457(b) is a supplemental retirement plan that is tax-deferred meaning you don’t pay taxes on your money until withdrawal. A 457(b) plan offers flexibility to save on a tax-deferred basis, while still having access to your money through loans, and unforeseen emergency distributions if the need arises.

If your employer offers both a 403(b) plan and a 457(b) plan, contributing the maximum allowed to both plans can maximize your retirement savings. One of our financial professionals can help guide you through this process.

Annuities, including fixed index annuities, are often used as the savings vehicle for 403(b) plans.

An annuity allows you to accumulate money with an insurance company that can earn interest and grow on a tax-deferred basis with the peace of mind that you will never lose money during a downturn in the market.* When you retire, you can either withdraw money as you need it or turn it into a stream of income you cannot outlive.

There are different types of annuities.

![]() Variable Annuity — The policy provides a choice of investment subaccounts as well as fixed income account options that you can direct your payments to. While variable annuities offer the upside potential of the securities market, they are also subject to the same declines the market experiences, which may result in a loss of principal and interest.

Variable Annuity — The policy provides a choice of investment subaccounts as well as fixed income account options that you can direct your payments to. While variable annuities offer the upside potential of the securities market, they are also subject to the same declines the market experiences, which may result in a loss of principal and interest.

Variable annuities can be offered solely by representatives registered to offer such products through a broker/dealer by way of prospectus. Investing involves risk, including the potential for loss of principal.

Variable annuities are sold by prospectus. For more complete information, please request a prospectus from your registered representative. Please read it and consider carefully a product’s objectives, risks, charges and expenses before you invest or send money. The prospectus contains this and other information about the investment company.

Fixed indexed annuities are insurance products designed to accumulate money for retirement. They offer guarantees against loss of premiums paid and interest earned due to a decline in the index.* They offer tax advantages and guarantee a stream of income during retirement, which helps to close your retirement income gap. Over the long term, the goal of a fixed indexed annuity is to offer more potential interest than a fixed annuity.

With an indexed annuity, you are not directly participating in any stock or equity investments. Instead, interest is credited based in-part on the change of a market index, such as the S&P 500**. This means you reap the benefits of an up market, but never lose value in a down market. If the index is down, you may not earn interest, but downside protection ensures that your cash value will not decline. You’ll never earn less than 0%.

In today’s uncertain economy, this peace of mind is more valuable than ever.

Stock market volatility in early 2020 wiped out trillions of dollars of market value: from March 6–11, the stock market lost approximately $6 trillion in wealth. But fixed and fixed indexed annuity owners didn’t lose a penny.2

2 Market Insider March 12, 2020 – Stock Market Erased $6 trillion in wealth last week.

Some of our annuity products offer an additional feature—or rider—to supplement your base policy, called a Guaranteed Lifetime Income Rider3. If managed properly, the Guaranteed Lifetime Income Rider can help to close your retirement income gap by paying you a set income each year in retirement. And it’s money you cannot outlive.

Not only does this feature give you guaranteed lifetime income, but it also provides access to the remaining accumulation value in the annuity if your needs change.

The lifetime income withdrawals reduce your accumulation value over time; however, if your accumulation value runs out before you die, income will still be paid to you until death. If you pass away with any remaining accumulation value in your policy, that money will be passed on to your beneficiary.

3 The Guaranteed Lifetime Income Rider (GLIR), as represented in rider form series 20365 or form series 20135(0613), 20136(0613) with endorsement 20380(0116), is a rider that can be added to an annuity policy at issue and is available on select fixed indexed annuities issued by Life Insurance Company of the Southwest. Electing this rider incurs an additional cost and rider charges continue to be deducted regardless of whether interest is credited.

Life is full of unknowns, and now is the time to consider smart ways to save for your retirement. This tool will take you through a series of quick questions about your retirement goals. Explore your retirement readiness today.

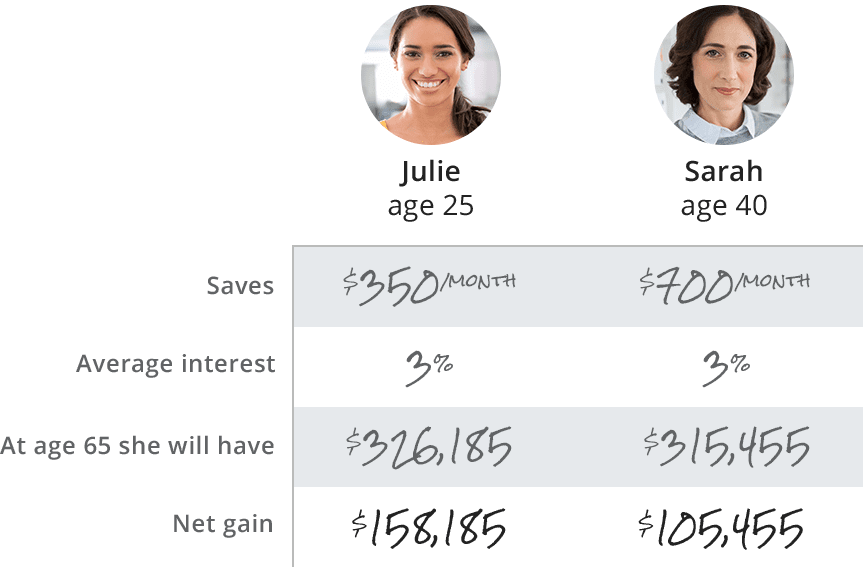

It’s never too late to start to save for retirement. But the numbers show that the earlier you begin, the better your outlook will be.

Are you saving enough for the retirement you want? Our quick and easy calculator can help you find out. Plus, it will point out any gaps you may have in your plan and help you address them.

![[stack of handbooks]](/-/media/Project/RHR/Retirement101/handbook-stack.png)

Meet with one of our financial professionals for a free session to start planning for a more secure retirement.